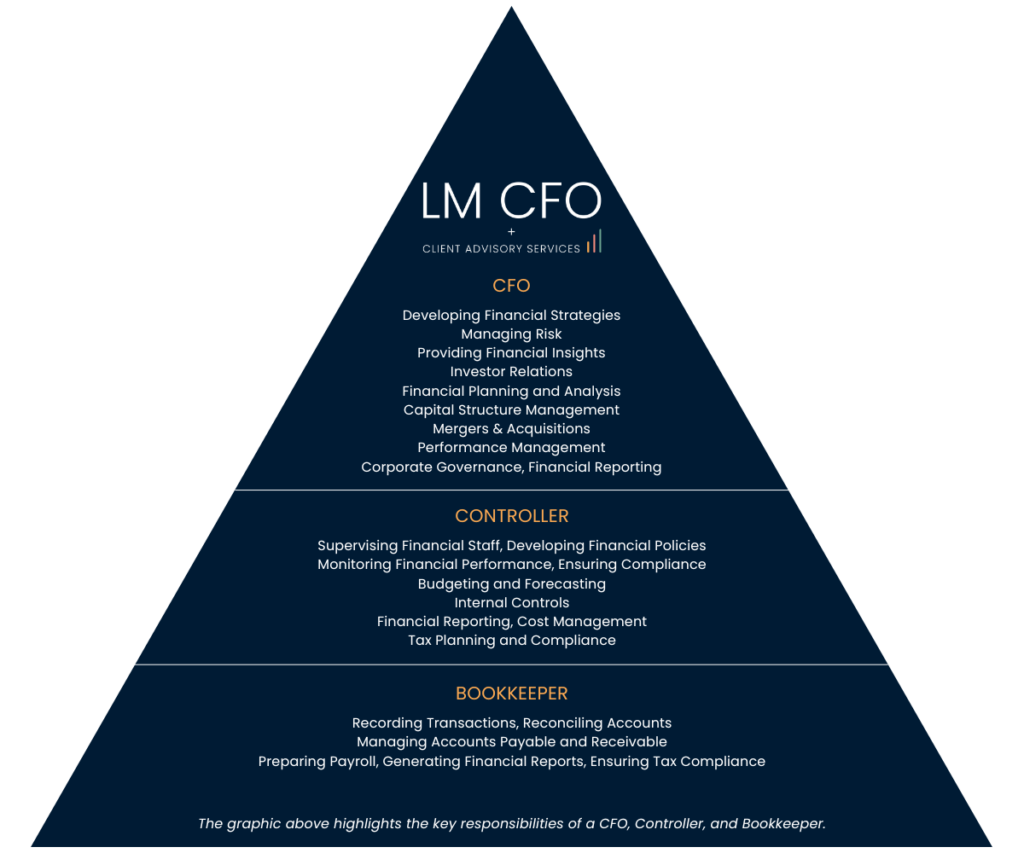

Bookkeepers, Controllers, and Chief Financial Officers (CFOs) are crucial to managing an organization’s financial health. Understanding the responsibilities and differences between these roles is essential for effective financial management. This article explores each role, highlighting the differences. Please reach out to our Partners, Moussa Hasbani or Maritza Ortiz if you are interested in learning more about our fractional bookkeeper, controller and CFO services.

The Bookkeeper: The Foundation of Financial Records

What is a Bookkeeper?

A bookkeeper is responsible for maintaining accurate and up-to-date financial records. Their duties include recording financial transactions, reconciling accounts, and ensuring that financial statements are correctly prepared. Attention to detail is critical, as even small errors can have significant consequences.

Key Responsibilities of a Bookkeeper:

- Recording Transactions: Bookkeepers handle day-to-day financial transactions, including sales, purchases, and expenses. This meticulous recording ensures that every financial movement within the organization is tracked.

- Reconciling Accounts: They regularly reconcile bank statements and other financial documents to ensure that the records are accurate and up-to-date. This process involves comparing the company’s records with bank statements to identify any discrepancies.

- Managing Accounts Payable and Receivable: Bookkeepers manage the flow of money in and out of the organization, keeping track of what is owed and what is due. They process invoices, make payments, and ensure that the organization receives payments on time.

- Preparing Payroll: They calculate employee salaries, deductions, and ensure that paychecks are issued accurately and on time.

- Generating Financial Reports: They produce financial reports that provide a snapshot of the organization’s financial status for higher-level financial professionals. These reports include balance sheets, income statements, and cash flow statements.

- Ensuring Tax Compliance: Bookkeepers track tax obligations and ensure that the company is compliant with federal, state, and local tax regulations.

The Importance of a Bookkeeper:

Bookkeepers are vital for an organization’s financial stability. Their meticulous record-keeping ensures accurate financial data, providing a solid base for informed decision-making. Without accurate records, strategic decisions made by higher-level executives could be flawed, potentially harming the organization’s financial health.

The Controller: The Overseer of Financial Compliance

What is a Controller?

Controllers oversee the bookkeeping process and implement financial policies, procedures, and strategies to ensure the organization’s financial health. They ensure compliance with legal and regulatory requirements and maintain internal controls.

Key Responsibilities of a Controller:

- Supervising Financial Staff: Controllers oversee bookkeepers and accountants, ensuring that all financial operations are performed accurately and efficiently. This includes training and supporting staff in their daily tasks.

- Developing Financial Policies: They develop and maintain financial policies and procedures that guide the organization’s financial operations. These policies ensure consistency, accuracy, and compliance across all financial activities.

- Monitoring Financial Performance: Controllers keep a close eye on the organization’s financial performance, identifying areas for improvement and ensuring that financial goals are met. They analyze financial data and provide insights into financial trends.

- Ensuring Compliance: They ensure that the organization complies with all legal and regulatory requirements, protecting it from potential legal issues. This includes preparing for and managing audits.

- Budgeting and Forecasting: Controllers develop budgets and financial forecasts, helping the organization plan for the future. They track budget performance and make adjustments as needed.

- Internal Controls: They establish and maintain internal controls to safeguard the organization’s assets. This includes implementing procedures to prevent fraud and ensure accurate financial reporting.

- Financial Reporting: Controllers prepare comprehensive financial reports for senior management and external stakeholders. These reports provide a detailed analysis of the company’s financial status.

- Cost Management: They analyze costs and identify opportunities for cost savings, improving the organization’s overall financial efficiency.

- Tax Planning and Compliance: Controllers oversee tax planning and ensure compliance with tax laws. They work to minimize the organization’s tax liabilities.

The Importance of a Controller:

Controllers safeguard an organization’s assets and ensure financial transparency. They provide valuable insights to support strategic decision-making and guide the company in the right direction. By establishing robust financial controls, controllers help prevent fraud and ensure that the organization’s financial practices are sound.

The Chief Financial Officer (CFO): The Strategic Financial Leader

What is a CFO?

The CFO is the highest-ranking financial executive in an organization, responsible for overseeing the entire financial operation, setting financial goals, and developing long-term strategies.

Key Responsibilities of a CFO:

- Developing Financial Strategies: CFOs develop and execute financial strategies to achieve the organization’s goals and drive growth. They align financial planning with the company’s overall business strategy.

- Managing Risk: They identify and manage financial risks, ensuring the organization’s long-term financial stability. This includes assessing market conditions and developing risk mitigation plans.

- Providing Financial Insights: CFOs provide valuable financial insights to guide executive decision-making, influencing the overall direction of the organization. They interpret complex financial data and present it in a way that supports strategic decisions.

- Investor Relations: They build and maintain relationships with investors and stakeholders, ensuring that the organization has the financial backing needed to achieve its goals. CFOs communicate the company’s financial performance and growth potential to investors.

- Financial Planning and Analysis: CFOs lead the financial planning and analysis (FP&A) process, including budgeting, forecasting, and financial modeling. They evaluate financial performance against strategic goals.

- Capital Structure Management: They manage the organization’s capital structure, including debt and equity financing. CFOs make decisions about capital allocation and funding sources.

- Mergers & Acquisitions: CFOs play a key role in mergers and acquisitions, from due diligence to integration. They assess the financial impact of potential deals and develop strategies for successful integration.

- Performance Management: CFOs establish performance metrics and monitor the organization’s financial performance. They ensure that financial targets are met and make adjustments as needed.

- Corporate Governance: They ensure that the organization adheres to corporate governance standards, enhancing transparency and accountability.

- Financial Reporting: CFOs oversee the preparation of financial statements and reports for internal and external stakeholders. They ensure that these reports comply with accounting standards and regulatory requirements.

The Importance of a CFO:

CFOs shape an organization’s financial future. Their strategic thinking and financial acumen drive growth and ensure long-term success. As visionary leaders, CFOs extend their role beyond the finance department, influencing strategic planning and participating in boardroom discussions.

The Collaborative Dynamics

Each role has distinct responsibilities, but each plays a different role in an organization’s financial well-being. Bookkeepers provide the necessary data, controllers establish financial controls, and CFOs use that information to make strategic decisions. An experienced CFO manages all these functions, extending their role beyond the finance department into strategic planning and boardroom discussions.

At LMC, we understand the complexities of financial management and the essential roles of bookkeepers, controllers, and CFOs. Our team supports your organization at every level, ensuring accurate financial records, compliance, and strategic financial planning. Whether you need bookkeeping services, financial oversight, or strategic financial leadership, LMC is here to help your business thrive.

To learn more about LM CFO and Client Advisory Services, contact Moussa Hasbani, LM CFO + CAS Managing Partner at [email protected] or Maritza Ortiz, LM CFO + CAS Partner at [email protected]