|

Op-Ed Written by Shahrzad Pantera |

How does someone obtain financial literacy? As we in the industry know, it is no small task. In today’s economic conditions and market activity, even an experienced and seasoned professional can have a hard time navigating the waters of financial planning. What about the 21 year old who just graduated college and is getting ready to buy their first car and is wondering how to invest in their 401K?

Financial literacy is an important topic, but also a critical aspect of my personal and professional life. My career, working in commercial lending, credit and in the banking industry, has provided me with a wealth of knowledge, but also the opportunity to share this knowledge with other people, including my family.

My children are now beginning their careers. They have the distinct advantage of having been raised with their mom being a banker, an advantage most may not have. Yet, they still have many questions and were not prepared to make many financial decisions. It is becoming apparent that they need guidance when making key decision regarding how to invest, save and plan for their future financial stability.

My two boys, ages 23 and 25, have the advantage of having graduated from top schools like Stanford University and Stevens Institute of Technology. Yet, they have many questions regarding personal credit. They felt unprepared when it came to applying for a home mortgage, preparing their taxes or applying for a credit card. They did not know what APY meant and asked me many questions on interest rates. They wanted to know what impact interest rates had on their car loans, what determined the interest rates that they were offered, and what key factors effected their credit score. In school they were taught how to read a P&L, and the key concepts of balancing your assets and liabilities. However, they never learned about key credit factors that affect the lives of young adults, ages 20 to 35 years old, who need financial literacy to manage their day- to-day finances.

Inflation, rising interest rates, student loan costs for college, medical bills and the changes we are seeing in markets from housing to the stock market, are some areas that need to be discussed. All of these issues have an effect on young people’s financial lives, and will continue to affect how the next generation handles decision making when it comes to their finances.

In general, a good rule to follow for the first step in financial planning is determining your short-term (under a year), mid-range (three to five year) and long-term (over five years) financial goals. The next step is setting a strategy that will achieve these goals.

Many planners use a SMART strategy to do this. Using this strategy means working together to set goals that are specific, measurable, achievable, relevant and timely — SMART.

SMART planning recognizes that the future is unpredictable and things can change. You may lose your job. You may face a recession or a natural disaster. This type of planning instills good habits you can revisit when the bad times pass.

Below are some steps to consider, that are important and follow the SMART strategy.

- Set a Budget and Stick to It

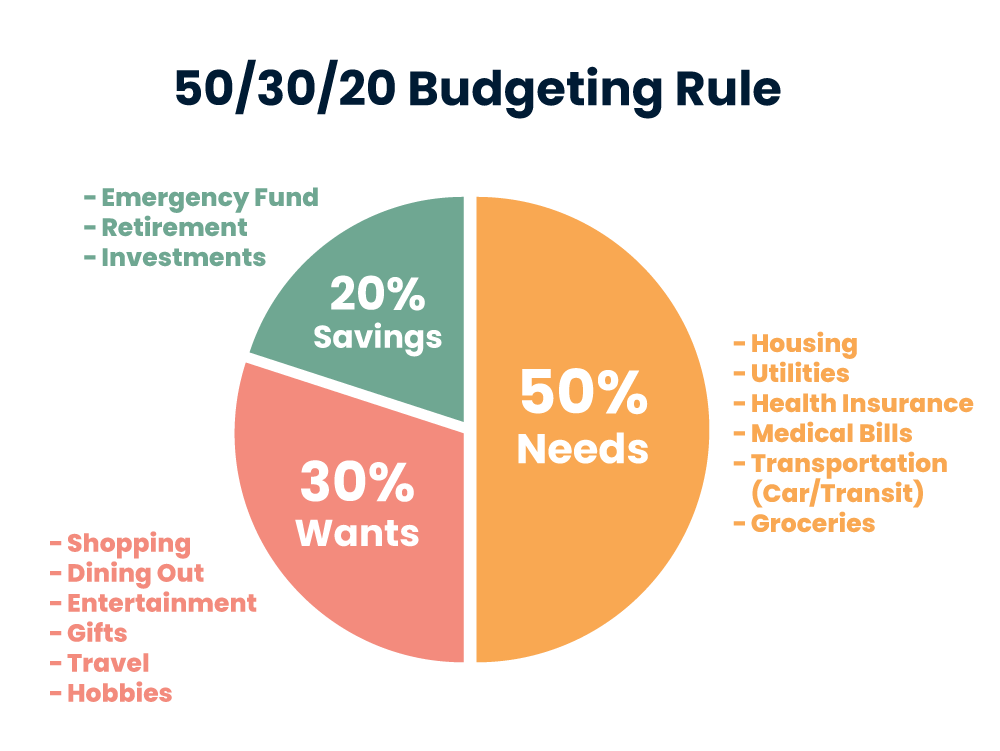

- Setting a budget gives you a true measure of your income and expenses. Fixed expenses, like rent or a mortgage, must be paid. Discretionary spending, like buying new clothing or eating out, are flexible. You can make these purchases or you can save that money toward a future goal. SMART budgets always include a line for savings. A 50/30/20 budget is a common standard budgeting outlook- where 50% is allocated to needs, 30% to wants, and 20% to savings.

- Save, Save, Save and Invest

- Circumstances can change quickly. If nothing else, the Covid-19 pandemic has taught us that. Having an emergency fund in a High Yield Savings Account with at least three months of liquidity should be a major goal. That may sound overwhelming, but even small savings add up over time. Saving for retirement is another important goal. With good financial advice, investing, even small amounts, can yield large yields over time. Investors often gain financial literacy by investing money in stock market and index funds, which historically have long-term returns. Real estate investing can also be part of a long-term hedge against inflation.

- Be Aware of When and How You Use Your Credit Card

- Paying off credit card debt goes hand in hand with your credit score. In general, the three top credit-scoring agencies regard under 10% of credit card debt as the gold standard. Things happen, and sometimes unexpected expenses arise. Your goal should be paying these debts as quickly as possible. Being aware of how you use your credit card is another aspect of achieving your SMART goals.

- Evaluate Student Loans

- Student loan debt can be part of your budget from the time you graduate until well into your mid-career years. You have options. It may be possible to refinance the loans at a lower rate or even have them forgiven.

- Pay Bills on Time for a Strong Credit Score

- Earning a lower interest rate for loans can save thousands of dollars each year. The best way to earn a lower rate is to build a high FICO score. A score of 800 (or above) is widely considered to be “excellent” by lenders. But how do you reach that score?

- According to FICO, your payment history makes up 35% of your FICO credit score. That makes this the most important factor in determining your score. The payments you make on certain monthly bills — including your credit cards, mortgages, auto loans as well as personal and student loans, are reported each month to the national credit bureaus Experian, Equifax and TransUnion.

- If you make these payments on time, your credit score will gradually increase. If you make them late, your credit score can fall by 100 or more points.

The Bottom Line

Financial Literacy is so important for our youth. It is no easy task, by any means, as there will always be unexpected factors effecting an individual’s finances. I believe that by being intentional with your finances, applying the SMART goals knowledge into practice, and improving your finances every day, will be beneficial in the long-term. Also, financial education needs to be taught and implemented in the classroom curriculum and at home, in order for the younger generation to jump start their financial literacy journey.

Subscribe to LMC’s the Bottom Line monthly e-newsletter: